Chapter 12.8: Foundations and Turmoil: Tracing Economic Milestones from Bimetallism to The Great Depression

Transitioning smoothly from the exploration of economic thought centred on Mises and Keynes to the broader historical narrative requires a link that not only recapitulates the prior discussions but also sets the stage for the comprehensive examination of pivotal events shaping the financial world from 1881 to 1936.

From Theory to Turmoil: Charting the Course of Economic Milestones

As we concluded in Chapter 12.7, 'Bridging Eras: Economic Thought from Mises to Keynes,' the interwar years were not only a period of significant economic turmoil but also a time of profound intellectual ferment. The contributions of Ludwig von Mises and John Maynard Keynes highlighted contrasting approaches to economic analysis and policy, epitomising the broader debates that would shape economic thought throughout the 20th century. These discussions, however, did not occur in isolation. They were deeply influenced by, and in turn influenced, a series of dramatic events and transformations in the global financial landscape.

Moving forward, Chapter 12.8, 'Foundations and Turmoil: Tracing Economic Milestones from Bimetallism to The Great Depression,' expands our lens to encompass the broader array of pivotal events and developments from 1881 to 1936.

Innovation and Turmoil: Weaving the Fabric of Economic Thought

This period, rich with innovation, crisis, and policy shifts, offers a crucial context for understanding the evolution of economic theory and practice. From the debates over the gold standard and the impact of technological advancements to the cataclysmic effects of the Great Depression, this chapter seeks to weave together the threads of economic history that informed and were reshaped by the seminal works of thinkers like Mises and Keynes.

In doing so, we embark on a detailed exploration of how these macroeconomic and microeconomic shifts contributed to the evolving landscape of economic thought, setting the stage for the post-World War II era. The narrative that unfolds is one of complexity and contradiction, of crisis and innovation—a narrative that underscores the interconnectedness of economic theory, policy, and the real-world events that challenge and refine them.

This lead-in effectively bridges the intellectual journey from Mises and Keynes to the broader historical events, setting a comprehensive stage for a deep dive into the economic milestones that defined and were defined by the tumultuous period between 1881 and 1936.

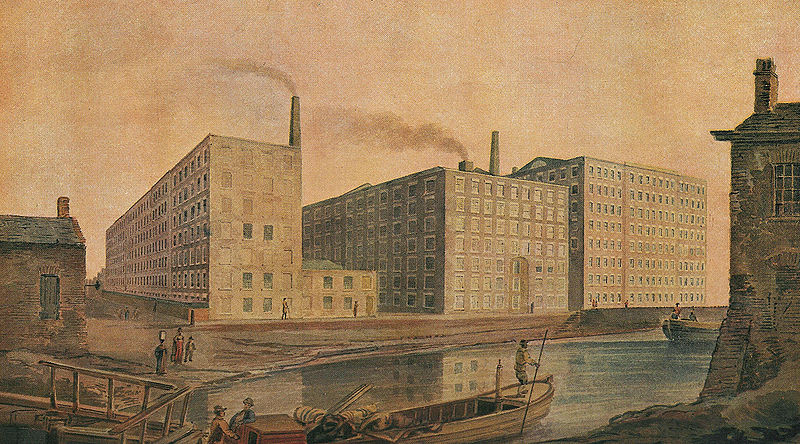

The period from 1881 to 1936 was rich with significant events that shaped the landscape of the financial world, leading up to and influencing the understanding of economic phenomena such as the Panic of 1819. Here are some key events and developments:

1. Bimetallism and the Gold Standard:

The "Crime of 1873" (1873) Refers to the United States' de facto transition to the gold standard by ceasing the minting of silver dollars, which had significant economic implications and was a contentious issue until the early 20th century.

2. Adoption of the Gold Standard:

Many countries formally adopted the gold standard in the late 19th and early 20th centuries, stabilising currencies and setting the stage for future monetary challenges.

3. Banking Reforms and the Establishment of Central Banks:

The late 19th and early 20th centuries saw the establishment or modernisation of central banks in various countries, such as the Federal Reserve System in the United States in 1913, aimed at stabilising the banking system and managing the nation's monetary policy.

4. The Great Depression (1929-1939):

Beginning with the stock market crash in October 1929, the Great Depression was a worldwide economic downturn that profoundly affected industrialised countries. It led to significant changes in economic policy and theory, including the development and acceptance of Keynesian economics.

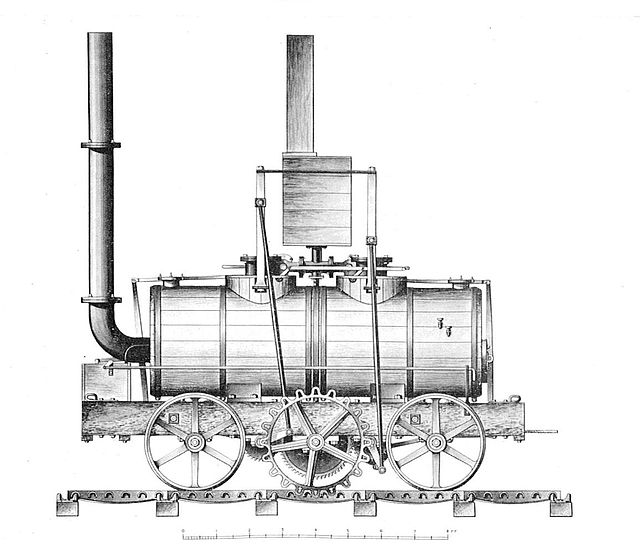

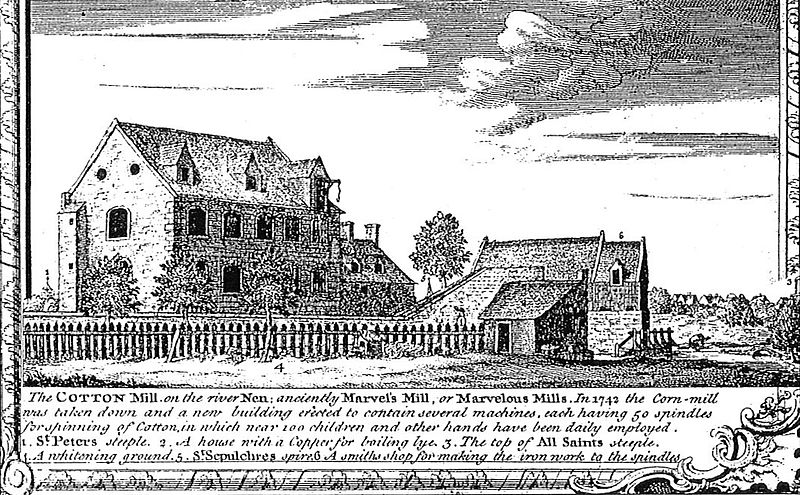

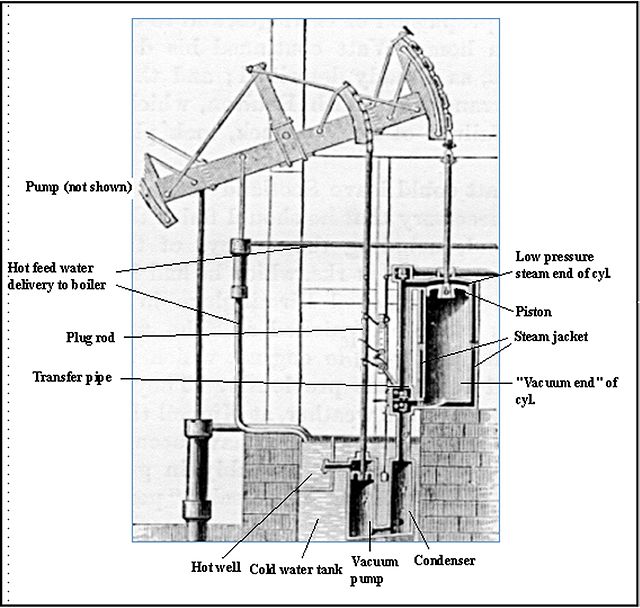

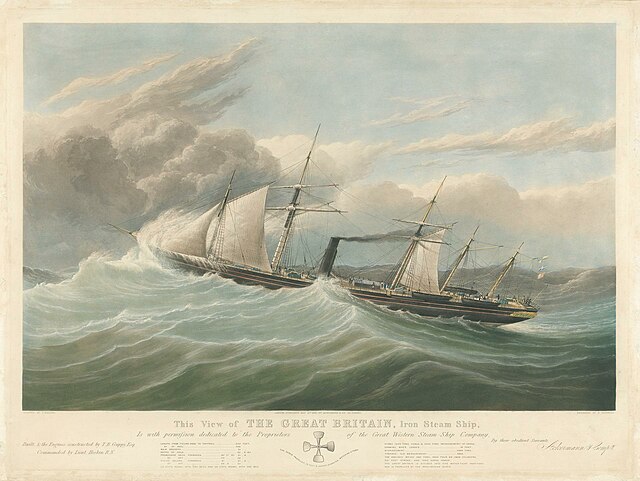

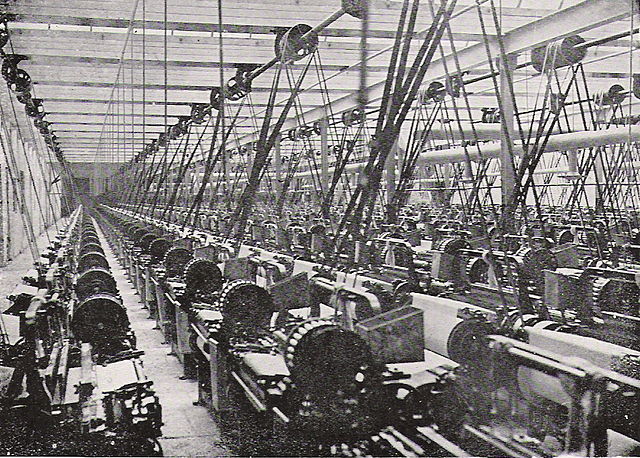

5. Technological and Industrial Advances:

This period saw significant technological and industrial advances, including the Second Industrial Revolution (late 19th century), which transformed economies through developments in electricity, telecommunications, and manufacturing.

6. World War I (1914-1918):

The economic impacts of World War I were vast, including massive government spending, inflation, and shifts in global economic power. The war also led to changes in the global financial system, including the United States emerging as a major creditor nation.

7. The Return to the Gold Standard and Subsequent Abandonment:

Post-World War I, Britain and other countries attempted to return to the gold standard at pre-war parity, leading to economic strain. The British Gold Standard Act of 1925 is a notable example. By the 1930s, the gold standard was abandoned mainly in response to the Great Depression.

8. Stock Market Boom of the 1920s and the Crash of 1929:

The speculative bubble of the late 1920s, followed by the stock market crash in October 1929, marked the beginning of the Great Depression, underscoring the need for regulatory oversight of financial markets.

9. International Economic Conferences and Agreements:

Events like the Genoa Conference (1922) and the Bretton Woods Conference (1944, just beyond your period of interest) were pivotal in reshaping international monetary policy and financial cooperation.

This era was marked by significant economic theories, policies, and institutions that laid the groundwork for modern economic thought and policy-making. Each of these events contributed to the evolving understanding of economic dynamics, influencing the development of economic theory and policy in response to the challenges of the time.

Closing Statement of Chapter 12.8:

As we close Chapter 12.8, "Foundations and Turmoil: Tracing Economic Milestones from Bimetallism to The Great Depression," we have traversed a landscape rich with events that have not only shaped the financial world but also profoundly influenced the fabric of modern economic thought. This journey through pivotal moments from 1881 to 1936 underscores the intricate web of economic theories, policies, and the real-world challenges they aim to address.

Our exploration, however, does not end here. While we have detailed significant advancements and upheavals in the economic sphere, a retrospective glance at an earlier event awaits—The Panic of 1819. This pivotal moment in economic history, though seemingly distant, offers valuable insights into the genesis of the complexities we have navigated thus far.

Why Chapter 13 Follows:

You might wonder why a discussion on the Panic of 1819 follows our in-depth analysis of the period from 1881 to 1936. The rationale lies in the pedagogical approach adopted for this exploration. By first understanding the outcomes and evolutions in economic thought and policy up to the Keynesian Revolution, readers can more profoundly appreciate the foundational shifts initiated by earlier crises. The Panic of 1819, while predating the events of Chapters 12.7 and 12.8, serves as a crucial historical anchor, illustrating the cyclical nature of economic crises and the evolving responses they engender.

This strategic positioning allows us to reflect on the continuity and change in economic thought, providing a more nuanced comprehension of the challenges and innovations that have shaped economic policy and theory. Thus, Chapter 13 not only circles back to a critical juncture in economic history but also enriches our understanding of the developments that followed.

Notations and Disclaimers:

This narrative is intended to provide a broad overview of significant economic events and theories. While every effort has been made to ensure accuracy, the complexity of economic history and theory means that interpretations and emphasis may vary. Readers are encouraged to consult primary sources and scholarly works for more detailed analysis.

Further Reading:

- "Principles of Economics" by Alfred Marshall - For insights into microeconomic foundations.

- "The General Theory of Employment, Interest, and Money" by John Maynard Keynes - To explore the roots of Keynesian economics.

- "Human Action: A Treatise on Economics" by Ludwig von Mises - For an in-depth look at Austrian economic theory.

- "The Worldly Philosophers" by Robert Heilbroner - For a broader historical perspective on the lives, times, and ideas of great economists.

- "The Great Depression: A Diary" by Benjamin Roth - To understand the human impact of economic crises.

Looking Ahead to Chapter 13:

As we pivot to Chapter 13 and delve into the Panic of 1819, we embark on a journey that not only explores the origins of economic crises but also sets the stage for the subsequent waves of thought and policy that have aimed to mitigate such upheavals. This exploration is not merely academic; it is a quest to understand the forces that have shaped our present and will continue to influence our future in the realm of economic policy and theory.