Chapter 8 - Britain's Demise as the World's Reserve Currency

The rise and fall of empires have historically left indelible marks on the global economic landscape. As the British Empire grappled with the challenges of its waning power, a silent transformation occurred in banking and finance. This chapter delves into the decline of the British pound sterling as the world's primary reserve currency and the factors that precipitated its downfall.

The Power of the Pound Sterling

Image is Public domain, via Wikimedia Commons

19th century counterfeit plate of Bank of England five-pound

At the height of the British Empire's glory, the pound sterling was the cornerstone of global trade, finance, and banking. This section delves into the pound's dominance and its ubiquity in transactions across the globe.

Economic Strains of the World Wars

Image is Public Domain, via Wikimedia Commons

The financial toll of the World Wars drastically weakened the British economy. Massive debt accumulation and depletion of gold reserves cast a shadow on the pound's reliability as the world's primary reserve currency.

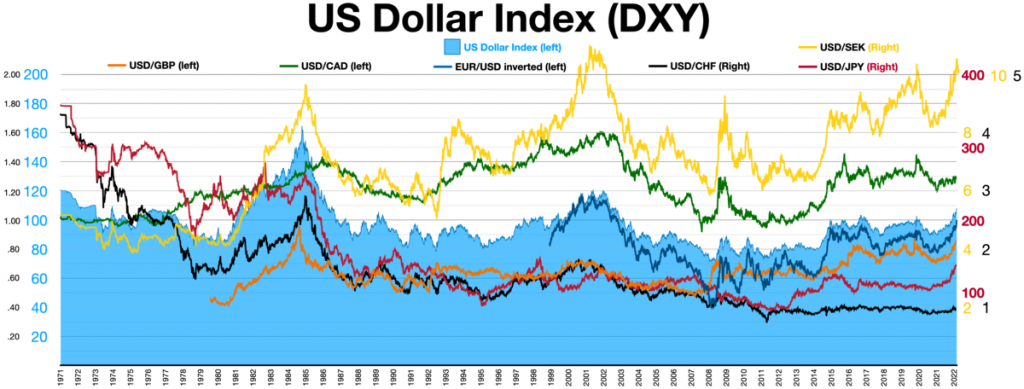

Emergence of the U.S. Dollar

Image by Wikideas1, CC0, via Wikimedia Commons

Post World War II, the United States emerged as an economic powerhouse. With the Bretton Woods Agreement in 1944, the U.S. dollar pegged to gold, began its ascent, challenging the pound's supremacy.

Decolonisation and Economic Flux

Llywelyn2000, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

As Britain decolonised rapidly, the newly independent nations sought to establish their financial systems, often reducing their reliance on the pound.

The Devaluation Crisis of 1967

Image by Eric Koch for Anefo, CC BY-SA 3.0 NL https://creativecommons.org/licenses/by-sa/3.0/nl/deed.en, via Wikimedia Commons

In 1967, Britain faced an economic crisis leading to the pound's devaluation. This monumental decision, taken by Prime Minister Harold Wilson, further eroded confidence in the pound on the global stage.

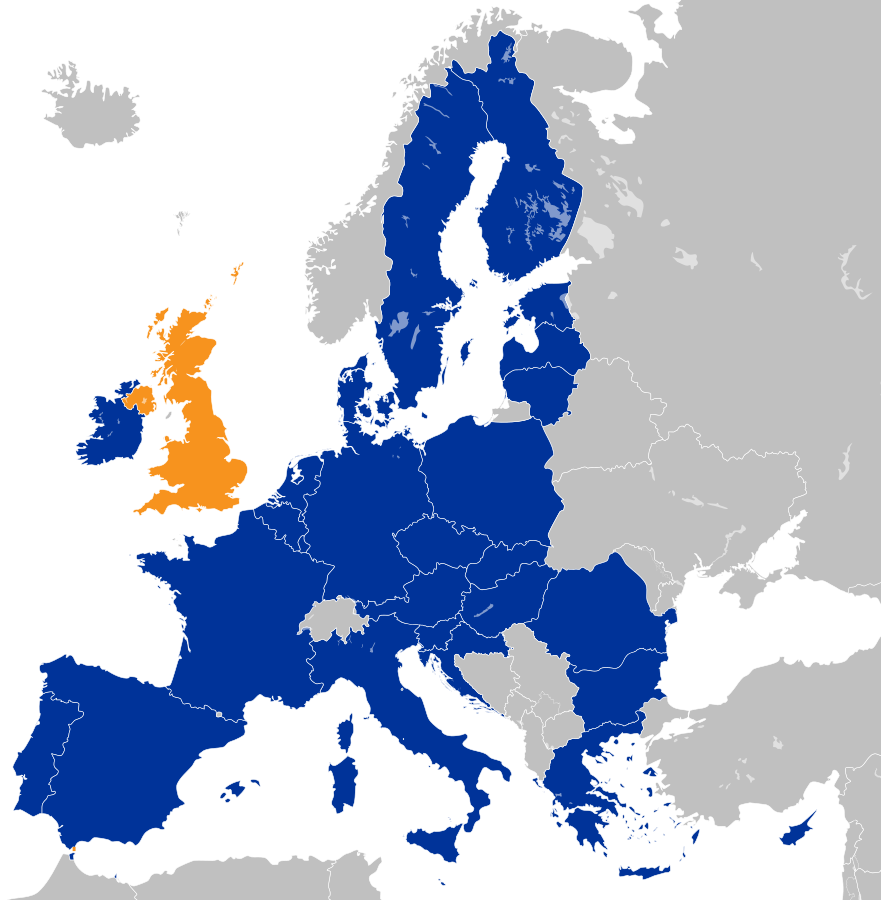

Britain's Transition and the Euro

Image by Furfur, Public domain, via Wikimedia Commons

Britain's relationship with the European Economic Community and later the E.U. played a role in the pound's status. The debate around joining the Euro and, later, Brexit had substantial financial implications.

The Modern Era and the Pound's Role

Image by Wazouille, Public domain, via Wikimedia Commons

The pound still plays a crucial role in today's globalised economy, but its dominance has waned. It remains a major currency, but its era as the primary reserve currency is a chapter in history.

The pound sterling's journey from dominance to its current status reflects broader geopolitical, economic, and historical changes. As empires rise and fall, so do their currencies. The shifting tides of global power influence the financial systems and dictate the flow of money, trade, and investments. The subsequent chapter delves into the rise and challenges of the next powerhouse currency - the U.S. dollar.

CONCLUSION

As we turn the pages to Chapter Nine, we dive into the tumultuous aftermath of the War of 1812. While the Treaty of Ghent in 1814 marked the end of military conflicts, it inadvertently set the stage for a different kind of battle — an economic one. While the Treaty of Ghent in 1814 settled diplomatic tensions, the young American nation now grappled with financial tremors, leading to the great crash of 1819. Join us in this chapter as we navigate the intricate landscape of post-war America, from booming patriotism to the shadows of the first significant financial panic.

Notations

- Images are for illustrative purposes only.

- It is essential to reiterate that the information provided in this blog series and all discussions related to finance do not constitute financial advice. Readers should conduct due diligence, consult financial professionals, and make informed decisions based on financial circumstances and goals. Financial markets and investment strategies are complex and subject to change, and what works for one person may not be suitable for another. It is always wise to exercise caution and seek personalised financial advice when making financial decisions.

Leave a Reply