Chapter 4 - The Fall of Empires - Lessons for the Present

A 14th-century manuscript depicting bankers in an Italian counting house.

Image by Cocharelli, Public domain, via Wikimedia Commons

Introduction

As we embark on a journey through the captivating annals of banking and financial dominance, we are compelled to pause and reflect upon the sagas of empires—on their rises, zeniths, and eventual declines. The narratives of Portugal, Spain, the Dutch Republic, the Portuguese Real, and the Roman Empire hold profound insights that continue to resonate today.

In our first episode, we delve into a pivotal chapter of history, scrutinizing how the mighty Roman Empire met its demise under the weight of financial malpractice. From there, we explore the accounts of nations such as Portugal, Spain, Holland, France, Great Britain, and America—nations teetering on the precipice as the world reserve currency hangs in the balance.

Solidus of Theodosius II, minted in Constantinople c. 435. This design of the emperor with the spear over his shoulder was the conventional portrait for over a century in the Eastern Roman Empire, from AD 395 to 537.

Image by Heritage Auctions, Public domain, via Wikimedia Commons

Ancient Beginnings: The Evolution of Economics and Banking

As we venture into the captivating annals of banking and financial dominance, we must pause and reflect upon the sagas of empires, their ascents, and their eventual declines. The stories of Portugal, Spain, the Dutch Republic, the Portuguese Real, and the Roman Empire offer profound insights that continue to resonate today.

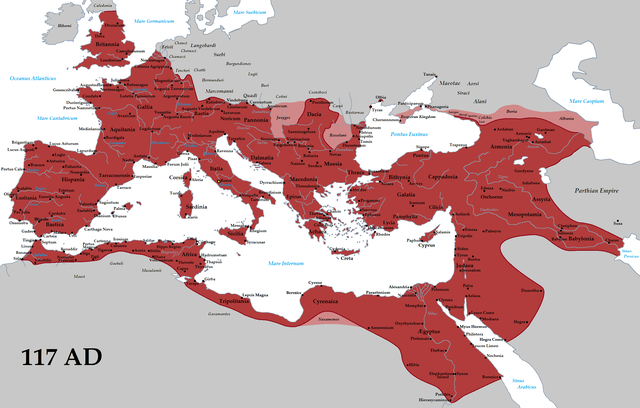

Roman Empire at its territorial greatest extent in 117 AD, the time of Trajan's death. Image by Tataryn, CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0, via Wikimedia Commons

The Roots of Banking

The history of banking traces its origins back to ancient civilizations. Prototype banks emerged around 2000 BCE in Assyria, India, and Sumer. These early institutions, often based in temples, provided grain loans to farmers and facilitated trade by accepting deposits and exchanging money. Similar practices were observed in ancient Greece and during the Roman Empire.

The cleansing of the Temple narrative tells of Jesus expelling the merchants and the money changers from the Temple and is recounted in all four canonical gospels of the New Testament. The scene is a common motif in Christian art.

Image by National Gallery of Art, CC0, via Wikimedia Commons

However, the foundations of modern banking can be found in medieval and Renaissance Italy, particularly in cities like Florence, Venice, and Genoa. Families like the Bardi and Peruzzi dominated banking in 14th-century Florence, establishing branches across Europe. The renowned Medici Bank, established in 1397, further solidified Italy's role as a financial hub. Banca Monte dei Paschi di Siena, founded in 1472, remains the world's oldest continuously operating bank.

Banking's Spread and Evolution

Banking's development gradually extended from northern Italy throughout the Holy Roman Empire, eventually reaching northern Europe in the 15th and 16th centuries. Key innovations emerged in Amsterdam during the Dutch Republic in the 17th century and in London from the 18th century onwards. As the 20th century unfolded, advancements in telecommunications and computing revolutionized banking operations, enabling institutions to grow in size and expand globally.

Modern Challenges and the Financial Crisis

The 21st century has ushered in new challenges for the banking industry. Developments in technology, while offering opportunities, also posed significant threats. The global financial crisis of 2007–2008 resulted in numerous bank failures, including some of the world's largest institutions, sparking intense debates about the need for enhanced bank regulation.

The Triumphs and Pitfalls of Empires

Empires throughout history have wielded financial power and influence that spanned the globe. They expanded their territories, established dominion over trade routes, and amassed vast wealth. However, these very strengths often sowed the seeds of their eventual decline.

Lessons in Prudent Management

One recurring lesson is the paramount importance of prudent financial management. While wealth and expansion can be sources of strength, unchecked growth and reckless overspending can lead to instability and, ultimately, collapse. Empires must artfully balance their ambitions with responsible resource allocation.

Currency as a Reflection of Empire

The histories of Portugal, Spain, and the Dutch Republic illuminate the pivotal role of currency as a reflection of an empire's strength. A stable and widely accepted currency can bolster an empire's economic dominance, while currency devaluation can have far-reaching and dire consequences.

Innovation and Adaptability

Empires that thrived in the past were often pioneers in financial innovation and adaptability. They introduced groundbreaking concepts such as loans, bills of exchange, central banks, joint-stock companies, and modern banking practices. These innovations served as the bedrock of their financial prowess.

Applying Historical Wisdom

In our modern era, marked by complex financial systems and globalized economies, the lessons derived from the histories of these empires remain eminently relevant. Prudent financial management, responsible growth, and a culture of innovation can guide nations and institutions as they forge a path toward a stable and prosperous financial future.

Conclusion

As we continue to explore the history of banking and finance, the stories of empires and their financial ascendancy serve as a timeless wellspring of wisdom. They serve as poignant reminders of the delicate equilibrium that must be struck to wield financial power effectively and sustainably. By gleaning knowledge from the annals of the past, we equip ourselves to navigate the intricate challenges and seize the boundless opportunities of the ever-evolving world of banking and finance.

In the forthcoming chapters of this series, we shall delve even deeper into the intricacies of financial history, uncovering more captivating narratives of innovation, adaptability, and the enduring influence of financial systems on society. We invite you to join us on this enlightening journey through the history and future of banking and finance, drawing inspiration from past lessons to shape a more resilient financial landscape for tomorrow.

Leave a Reply