CHAPTER 1 - Ancient Beginnings: The Evolution of Economics and Banking

Medieval Bank – 14TH CENTURY

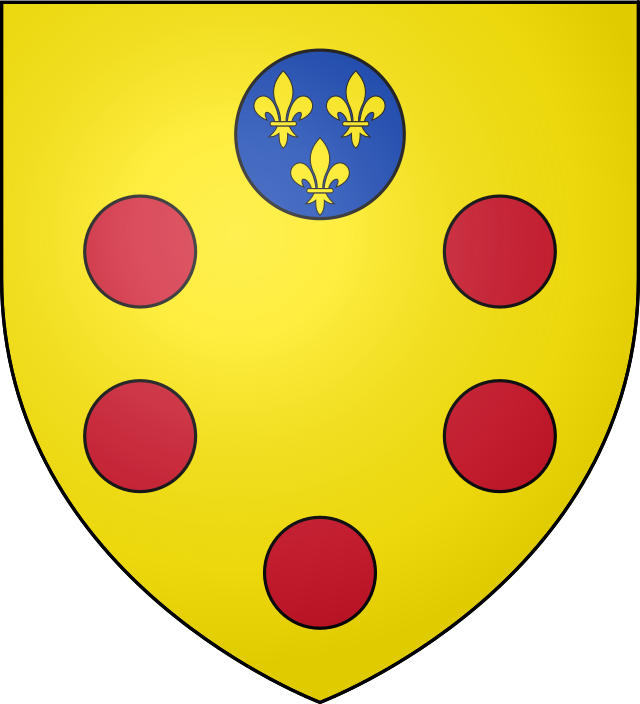

The Bardi and Peruzzi families dominated banking in 14th-century Florence, establishing branches in other parts of Europe. One of the most famous Italian banks was the Medici Bank, set up by Giovanni di Bicci de Medici in 1397.

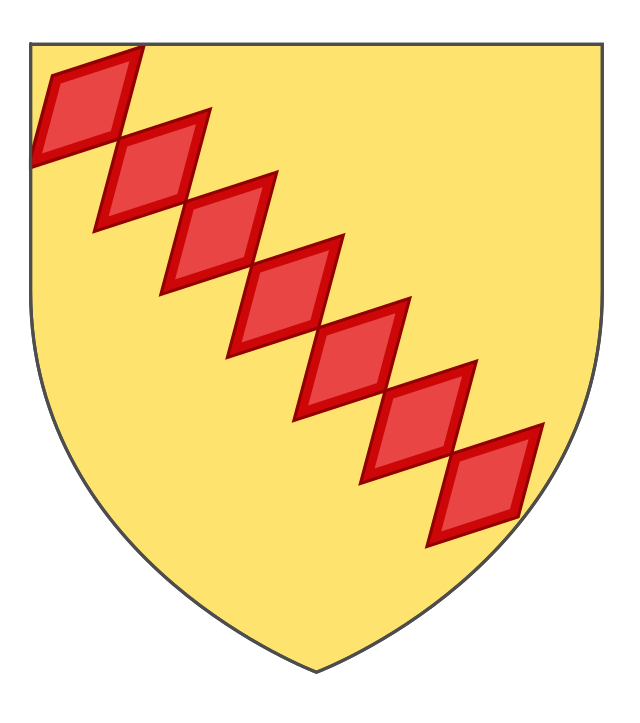

Bardi

Medici

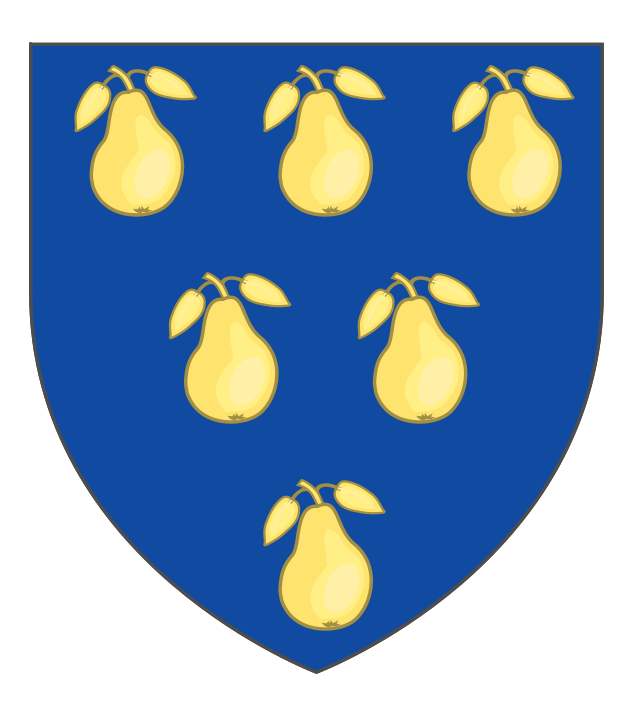

Peruzzi

Banking in the United Kingdom can be considered to have started in the Kingdom of England in the 17th century. The first activity in what became known as banking was by goldsmiths who began accumulating significant gold stocks after the dissolution of English monasteries by Henry VIII.

Modern Banking

image by Ruban2013, CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0, via Wikimedia Commons

The Birth of Economics

Economics, studying how societies manage their resources, has been a fundamental aspect of human civilisation since its inception. The earliest economic systems were based on simple barter, where individuals traded goods and services directly. However, this system had limitations, leading to the development of more sophisticated economic concepts.

Ancient Mesopotamia

Often regarded as the cradle of civilisation, Mesopotamia (modern-day Iraq) witnessed the emergence of the world's first written economic records. Clay tablets from around 3000 BCE contain information about agricultural production, trade, and taxation. These records suggest the existence of organised economic systems, including taxation and redistribution.

image from Metropolitan Museum of Art, CC0, via Wikimedia Commons

The Babylonian Plimpton 322 clay tablet, with numbers written in cuneiform script. Believed to have been written about 1800 BCE, this table lists two of the three numbers in what is now called Pythagorean triples.

The Role of Ancient Egypt

In ancient Egypt, the centralised administration of resources and labour was crucial for constructing monumental structures like the pyramids. This early form of economic planning laid the groundwork for managing resources and labour on a grand scale.

Image by Ricardo Liberato, CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0, via Wikimedia Commons

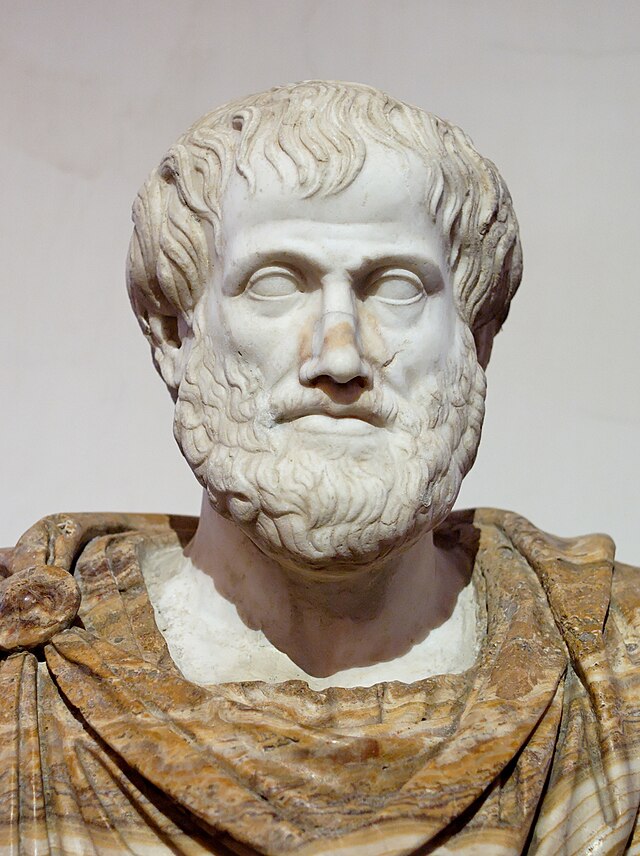

The Influence of Ancient Greece:

The Greek philosophers, including Aristotle, contributed significantly to early economic thought. Aristotle, for instance, pondered the ethics of wealth accumulation and the nature of money as a medium of exchange.

After Lysippos, Public domain, via Wikimedia Commons

The Advent of Banking

The origins of modern banking can be traced back to ancient civilisations that developed rudimentary banking practices and financial instruments.

Ancient Babylon

The Babylonians are credited with introducing concepts such as deposits and loans. Temples acted as early banks, safeguarding deposits of valuable assets, including grains and precious metals. These assets could then be loaned out to fund various endeavours.

Ancient Rome

The Roman Empire established the first centralised banking system. The "argentarii" were bankers who conducted various financial transactions, including lending, currency exchange, and money management. Roman coinage and the use of promissory notes were crucial in facilitating trade.

Medieval Banking Houses

During the Middle Ages, European banking houses, such as the Medici Bank in Florence, emerged as influential financial institutions. They were vital in funding trade ventures and supporting city-states' growth.

The Modern Banking Revolution

The evolution of banking continued into the modern era, with significant developments like the establishment of central banks, the adoption of fiat currencies, and the emergence of global financial institutions.

The Rise of Central Banks

The Bank of England, founded in 1694, is often regarded as the world's first central Bank. Central banks were critical in issuing standardised currency, regulating money supply, and maintaining financial stability.

Image from Lady Jane Lindsay, Public domain, via Wikimedia Commons

The Gold Standard: In the 19th and early 20th centuries, many countries adopted the gold standard, linking their currencies to a fixed amount of gold. This system promoted stability but limited monetary flexibility.

The Transition to Fiat Currency: In the 20th century, most countries moved away from the gold standard and adopted fiat currencies, which are not backed by physical assets but derive value from government decree.

Global Banking and Technology: Today, we live in an era of globalised banking, with financial institutions operating across borders. Technological advancements, including online banking and digital currencies like Bitcoin, continue to reshape the financial landscape.

Conclusion

In conclusion, the history of economics and banking is a fascinating tale of constant adaptation and development. It spans from the rudimentary barter systems of ancient civilisations to our intricate and interconnected global financial systems. This historical perspective is crucial for us to grasp the intricate economic framework that underpins contemporary society and empowers us to navigate the dynamic financial terrain effectively.

In the upcoming chapter, we will delve into the monetary system of the Roman Empire, shedding light on how the devaluation of the denarius, the empire's currency, played a significant role in its eventual downfall. This historical case study will provide valuable insights into the importance of sound monetary policy and its far-reaching consequences, lessons that continue to resonate in our modern world.

Leave a Reply