Echoes of War and the Birth of American Financial Instability

Chapter 9 - Panic of 1819: America's FIRST Great Economic Crisis

The Shifting Sands After 1815

As our narrative flows from Britain's declining hegemony and its role in global finance, we transition to a young United States, grappling with its identity and economic structure in the aftermath of the War of 1812. Though overshadowed by the Napoleonic Wars in Europe, this conflict was pivotal in shaping American financial history.

The War of 1812's Economic Backdrop

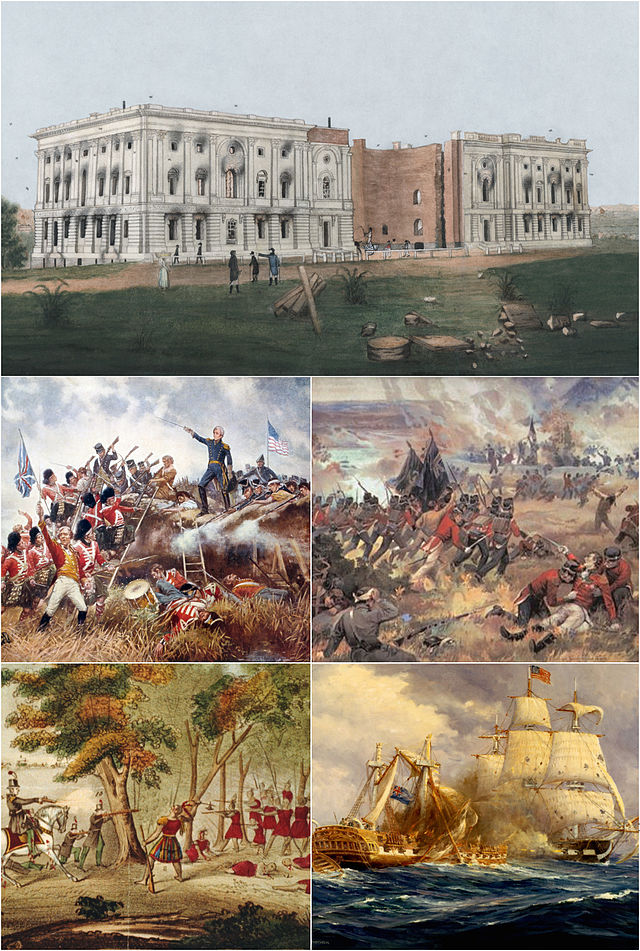

Damage to the United States Capitol after the burning of Washington

Mortally wounded Isaac Brock spurs on the York Volunteers at the battle of Queenston Heights

USS Constitution vs HMS Guerriere

The death of Tecumseh in 1813

Andrew Jackson defeats the British assault on New Orleans in 1815

Images clockwise, from top: George Munger, John David Kelly, Anton Otto Fischer, William Emmons, Edward Percy Moran, Public domain, via Wikimedia Commons

The War of 1812, often considered a second war of independence, brought about a surge in nationalist sentiment. However, it left the U.S. in a precarious financial state. The cost of the war strained the young nation's resources, and the interruption of trade with Britain wreaked havoc on its economy.

The Panic of 1819: Origins and Unfolding

Economic Expansion and its Pitfalls

In the years following the War of 1812, the U.S. saw economic expansion. This era was marked by the growth of the manufacturing sector and land speculation, spurred by easy credit from newly established banks, many unregulated and issuing their currencies. These speculative bubbles were the kindling for the financial conflagration that would follow.

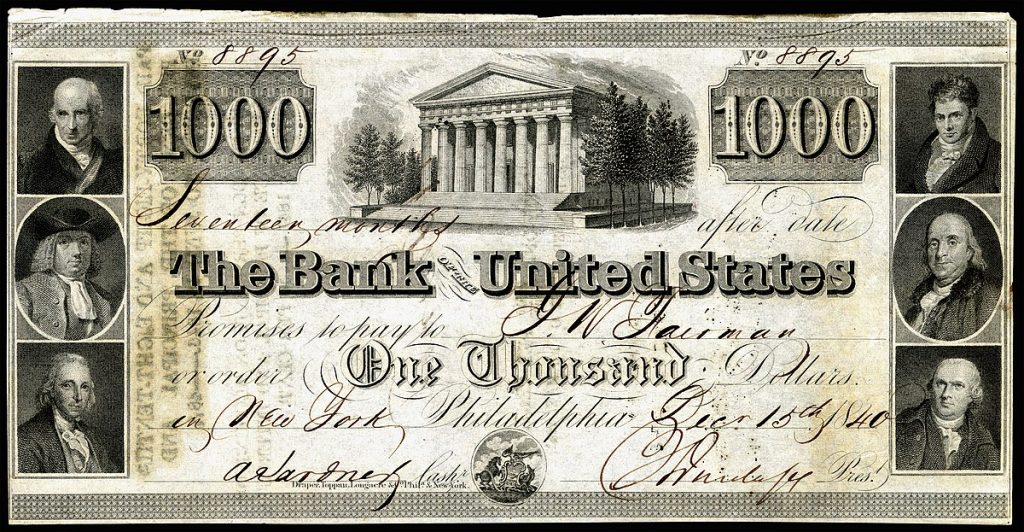

The Role of The Second Bank of the United States Banking Mismanagement

Image by Godot13 / Smithsonian Institute, Public domain, via Wikimedia Commons

Central to this story is the Second Bank of the United States. Chartered in 1816, this institution was tasked with stabilising the post-war economy. However, its policies, including tightening credit and calling in loans, arguably exacerbated the crisis. The contraction of credit, necessary to control inflation and stabilise the currency, had unintended consequences for a nation still finding its financial footing.

Land Speculation Fever

Image used is of a book cover, and the copyright for it is most likely owned either by the artist who created the cover or the publisher of the book. It is believed that the use of low-resolution images of book covers to illustrate an article discussing the book in question qualifies as fair use.

The Panic of 1819: Reactions and Policies is a 1962 book by the economist Murray Rothbard, in which the author discusses what he calls the first great economic crisis of the United States. The book is based on his doctoral dissertation in economics at Columbia University during the mid-1950s.

One of the significant contributors to the Panic of 1819 was the feverish speculation in Western lands. The vast territories that were newly accessible to Americans became hot commodities. Investors, many of whom were Eastern people in business, speculated on these lands, hoping for exponential returns. This frenzy was facilitated by lax lending practices and easy credit availability, notably from the Second Bank of the United States.

International Influences

Drawing parallels to Britain's dwindling financial dominance, American economic conditions were also swayed by international trends. The post-Napoleonic era in Europe led to a decline in demand for American agricultural products, a staple of the U.S. economy. This decrease in export earnings contributed to a shortfall in revenue, thereby straining both commercial and agricultural sectors.

Consequences: A Nation's Reflection

Social and Political Impacts

Bankruptcies surged during the Panic of 1819, leaving deep social and economic scars. Unemployment rose; prices fell, and for many Americans, this was their first encounter with a financial crisis of such magnitude. It triggered a shift in political attitudes towards banking and financial policy, laying the groundwork for future economic policies and political divisions.

A Learning Curve

This crisis also served as a learning experience. It underscored the challenges of managing a national economy and the dangers of speculative excess. Lessons from the Panic of 1819 influenced the debates around the role of a central bank, fiscal policies, and the regulatory framework governing banking and credit in the U.S.

Connecting Past and Present

As we juxtapose the demise of Britain's role in global finance with America's early struggles, a pattern emerges of how wars and their aftermath shape national economies. These events set nations on paths of financial experimentation, reform, and, occasionally, hardship. Understanding the Panic of 1819 within this broader historical context enlightens us about America's economic evolution and provides a mirror for reflecting on how countries manage fiscal crises and navigate the precarious balance between growth and stability.

CONCLUSION

Retrospect the Panic of 1819 is a testament to the cyclical nature of economies, with booms inevitably followed by busts. It underscores the necessity of prudent fiscal management and the potential dangers of unchecked speculation. While America has faced numerous economic crises since 1819, understanding this initial Panic provides invaluable insight into the country's economic evolution. It serves as a reminder of the need for balance, oversight, and the importance of learning from history to navigate future challenges.

As we venture into the next chapter, our focus shifts to the Gold Rush of 1849, another pivotal event that influenced the nation's economic trajectory, showcasing how discovery, innovation, and human ambition can spark profound transformations in a nation's fortune.

Notations

- Images are for illustrative purposes only.

- It is essential to reiterate that the information provided in this blog series and all discussions related to finance do not constitute financial advice. Readers should conduct due diligence, consult financial professionals, and make informed decisions based on financial circumstances and goals. Financial markets and investment strategies are complex and subject to change, and what works for one person may not be suitable for another. It is always wise to exercise caution and seek personalised financial advice when making financial decisions.

Leave a Reply